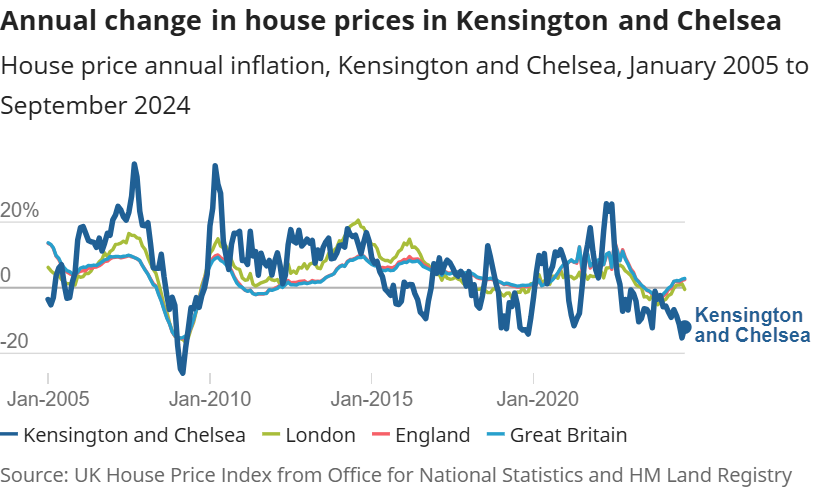

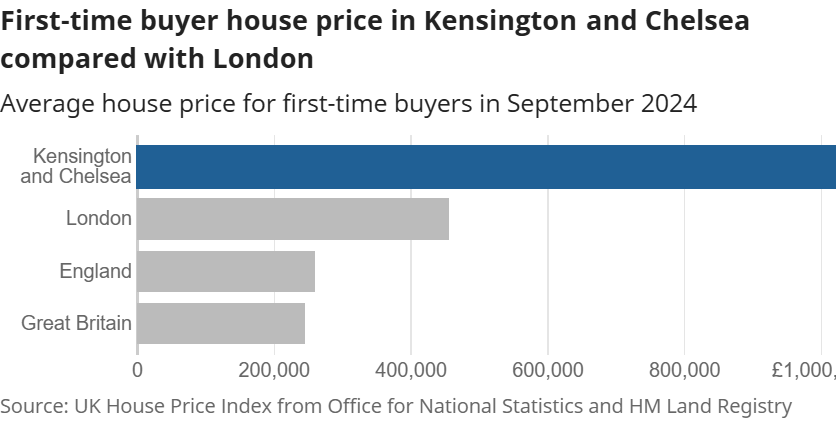

One of the primary benefits of purchasing a property here is the area’s enduring appeal and strong market performance. Properties in Kensington and Chelsea consistently retain their value and often appreciate due to high demand and limited supply. Additionally, the borough offers unparalleled luxury, heritage, and convenience with its iconic landmarks, green spaces, thriving retail and dining scene, excellent schools, and exceptional connectivity.

Kensington and Chelsea, often regarded as one of London's most prestigious boroughs, offers an unparalleled blend of luxury, heritage, and convenience, making it an exceptional place to live or invest. This iconic area is synonymous with elegant Victorian and Georgian architecture, tree-lined streets, and world-class amenities, drawing homebuyers from across the globe. Whether you're a professional seeking proximity to central London, a family looking for outstanding schools, or an investor targeting high-value properties, Kensington and Chelsea cater to all.

The borough boasts some of the highest average property prices in the UK, underpinned by its prime location, luxurious housing stock, and the cachet of owning a home in one of London's most desirable postcodes.

Beyond its property market, Kensington and Chelsea are famed for their cultural and recreational offerings. The area is home to iconic landmarks like Kensington Palace, the Royal Albert Hall, and the Natural History Museum, all of which contribute to its rich cultural heritage. Green spaces such as Hyde Park and Holland Park provide tranquil havens amid the urban landscape, ideal for outdoor activities or leisurely strolls. Residents also enjoy access to a thriving retail and dining scene, with the exclusive boutiques of King’s Road, High Street Kensington, and Sloane Square, alongside Michelin-starred restaurants and charming cafes.

The borough's exceptional connectivity is another key advantage. It offers quick and easy access to central London, Heathrow Airport, and international transport links via the District, Circle, and Piccadilly Tube lines. Additionally, the area is renowned for its top-tier educational institutions, including some of the best private schools and universities in the country, making it a sought-after location for families.

Kensington and Chelsea’s charm lies in its ability to seamlessly combine historic grandeur with modern convenience. From its vibrant arts and culture scene to its reputation as a secure and prestigious residential area, it’s no surprise that this borough remains a popular choice for discerning buyers. Whether you’re looking for a luxurious family home, a prime investment opportunity, or a pied-à-terre in the heart of London, Kensington and Chelsea promise a lifestyle of unmatched elegance and opportunity.